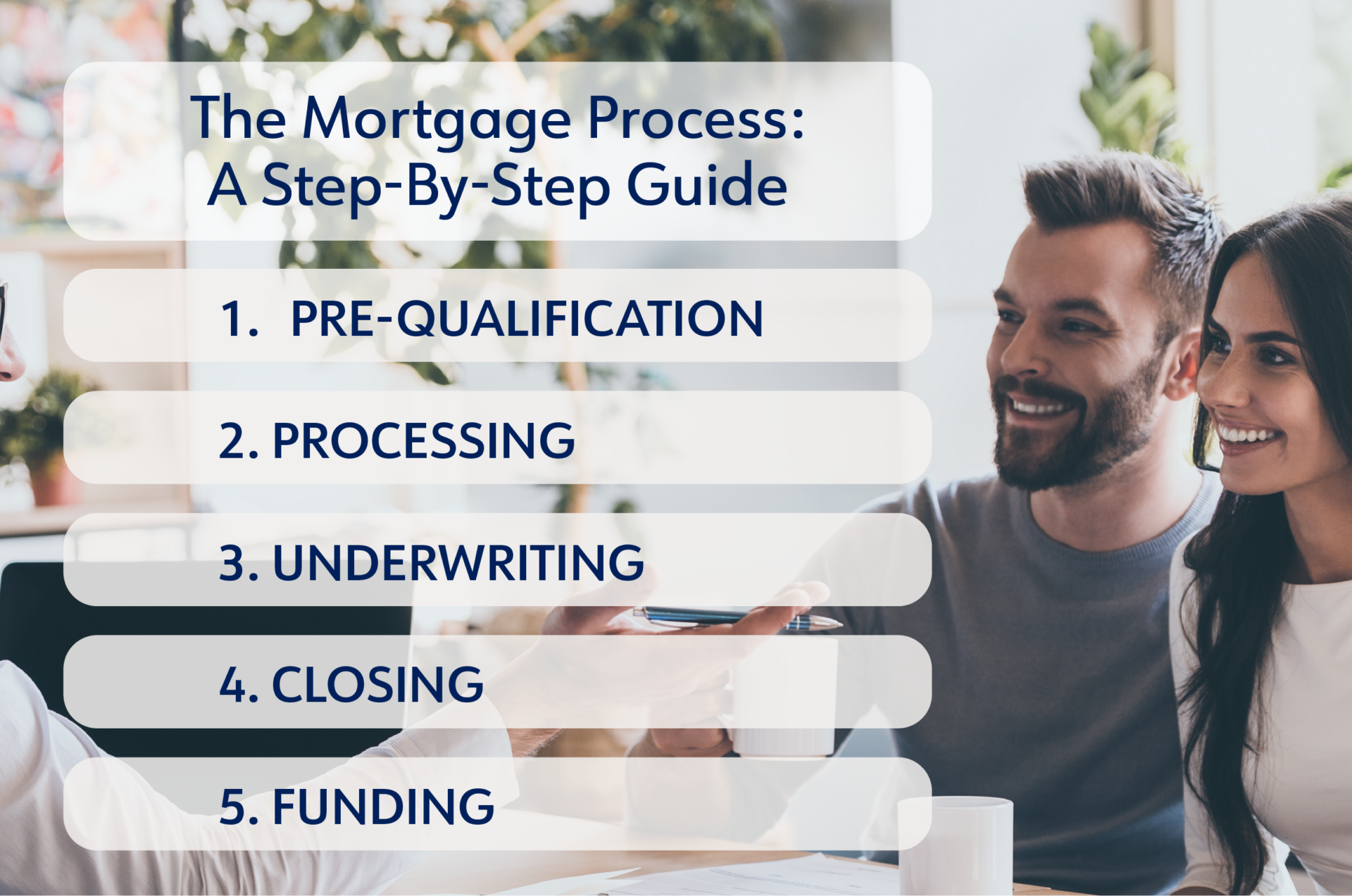

If you’re anything like us, the thought of buying a home is super exciting! But before you can start decorating and posting pics on social media, it’s important to understand what the mortgage process looks like and what to expect. In this post, we’ll break the process down into easy-to-follow steps so you know what to expect and can plan accordingly.

Step 1: Pre-Qualification

The first step in getting a mortgage is to get pre-qualified! This involves submitting a loan application, the lender pulling and reviewing your credit score, and potentially submitting a few documents. A Pre-Qualification is a quick way to establish how much you can afford when shopping for a home. It takes less documentation, and often works off estimates to establish what could be a good fit for your home financing. You can typically get a Pre-Qualification the same day you apply!

If you’re ready to start making offers on homes and want a more competitive solution, a Pre-Approval might be just the ticket! A Pre-Approval is a commitment to lend based on a nearly complete loan file review. The only item missing in a Pre-Approval scenario would be the property – the rest of the required loan documentation and details would be fully reviewed by our underwriters. Pre-Approvals offer strong evidence to sellers that you are a serious buyer and have a commitment from your lender to back it up!

Step 2: Processing

Once you have your Pre-Qualification, your loan file will be assigned to a processor. In this stage, you will need to provide some supporting documentation and the loan processor will review your file to verify income, assets, credit score, and more. Services to support the loan process, including appraisal and title insurance, will be ordered as well.

Step 3: Underwriting

Once your loan processor has gathered all the information needed, and ordered any supporting services, they will submit your loan file to underwriting. This team is dedicated to reviewing the file against loan program guidelines and lender requirements. Once reviewed, they will issue a decision on the file. If a conditional approval is issued, that simply means that the loan is approved, but there are some additional items to clear up before you can proceed to closing. If you receive a full approval and clear to close, you are ready to move on to the next step!

Step 4: Closing

Your mortgage loan closer will help finalize all details and documentation so you can sign! At this stage, you should receive your final Closing Disclosure, outlining all costs and fees associated with the transaction. You will receive this document prior to your closing day – so be sure to review it carefully and ask your Highlands Loan Originator if you have any questions! Once all looks good, you are set to sign! At Highlands, we have an awesome closing solution that will allow you to sign 85% or more of your closing documents digitally – saving time and hand cramps! A few documents may still need to be signed the old-fashioned way (ink pen and paper), but once you’re done with those few documents – it’s time for the BEST step in the process…

Step 5: Funding

In the funding stage, several things are happening to ensure your home purchase is finalized smoothly. The mortgage lender sends funds to the Settlement Agent and reviews all signed documents to make sure no details were missed. Once reviewed and all looks good, the mortgage funder will issue authorization to the Settlement Agent to disburse funds accordingly. This is when the deal is done! Keys are handed over and you are now a homeowner! Congratulations!

As you can see, there is quite a bit of detail work involved in a mortgage transaction – but at Highlands, we have seasoned professionals who make it look easy and ensure your experience is smooth and stress-free! At any point in your loan process, please feel free to ask questions so that you feel confident and comfortable. We hope this post has been helpful and gives you a sense of what to expect in the process.

If you are ready to get started, click HERE to find a Highlands Loan Originator in your area!