Ashleigh Smyth

Sr. Loan Officer

|

NMLS# 92328

Licensed for: FL-LO92660, GA-40408, NC-I-140362, SC-MLO-92328, TN-117241, VA-MLO-17801VA

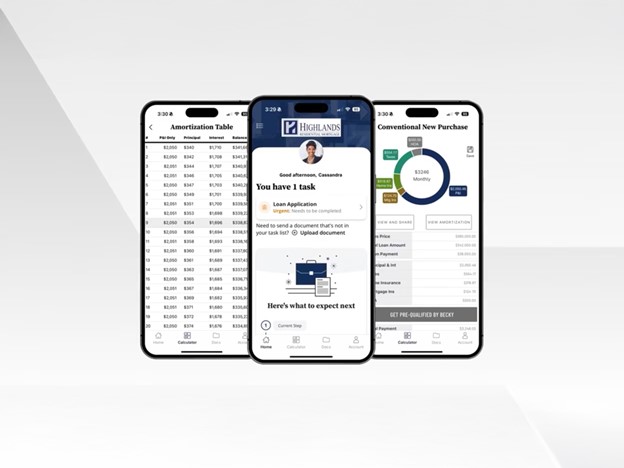

The Highlands Digital Mortgage Experience

The Highlands Residential Mortgage app makes it easy to plan, manage, and learn more about your personal loan process.